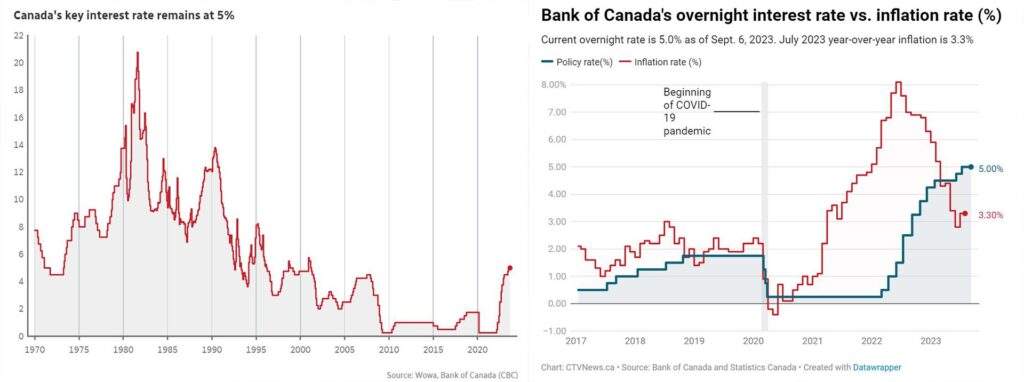

In a decision widely anticipated by economists and financial experts, the Bank of Canada has chosen to keep its key interest rate at five percent in its announcement on September 6th, highlighting recent indications of a weakening economy as a key factor.

The central bank’s rationale behind this decision is rooted in the need to provide time for previous rate hikes to yield results, considering that economic demand is currently on the decline.

The move comes in the wake of recent data revealing a contraction in Canada’s economy during the second quarter, alongside a three-month consecutive rise in the unemployment rate.

The Bank of Canada had previously raised interest rates in its last two meetings, ending a pause on rate hikes.

While the central bank acknowledges the importance of combatting inflationary pressures, it remains vigilant about the ongoing economic slowdown.

Canada’s inflation rate, which reached 3.3 percent in July and is expected to hover around three percent for the remainder of the year, has only intensified these concerns.

The Bank’s aggressive rate hike campaign, initiated in early 2022, has already made significant progress in curbing runaway inflation. However, the effects of rate adjustments often take up to 18 months to fully manifest.

With the lending rate having risen from near-zero to five percent in just a year and a half, there is a potential risk of overshooting and excessively slowing down the economy.

Several financial indicators in recent weeks have raised red flags. July’s job data, released in early August, indicated a loss of approximately 6,000 workers and a slight increase in the unemployment rate to 5.5 percent.

Later that month, GDP data from Statistics Canada confirmed a contraction in Canada’s economy during the second quarter of 2023, marking the first shrinkage since the onset of the pandemic—a possible indicator of a mild recession.

While a slowing economy aligns with the central bank’s efforts to bring inflation back to its target of two percent, the Bank of Canada maintains its readiness to further increase interest rates if deemed necessary.

In its accompanying statement, the bank emphasized its concern about the persistence of underlying inflationary pressures, signaling a commitment to raising the policy interest rate should circumstances demand it.

Royce Mendes, an economist at Desjardins, points out that the central bank’s policymakers are not closing the door to further rate increases.

Mendes underscores the hesitancy in signaling an end to the era of rate hikes, as prematurely suggesting that rates have peaked could inadvertently ease financial conditions.

Despite weaker economic indicators compared to the bank’s previous forecasts, Mendes believes the likelihood of additional rate hikes remains uncertain, concluding that the Bank of Canada may be nearing the end of its current rate adjustment cycle.